OLT Guide

OLT.com, short for OnLine Taxes, is an IRS-authorized e-file provider offering tax preparation software.

As a non-resident alien (NRA) navigating U.S. taxes, I've found OLT.com to be an invaluable resource. OLT.com offers IRS-authorized e-filing options tailored for NRAs like myself. While I initially hoped for a completely electronic filing process, I discovered I still needed to mail in my tax forms, a minor hiccup in an otherwise smooth experience.

Choosing the Right Form

Nonresident alien individuals, estates, and trusts should turn to Form 1040-NR for U.S. income tax filings. This form accommodates the unique aspects of our tax obligations.

Key Considerations for NRAs

Do you want to file Form 8840

You are not eligible for the closer connection exception if any of the following apply.

- You were present in the United States 183 days or more in the current year.

- You are a lawful permanent resident of the United States (that is, you are a green card holder).

- You have applied for, or taken other affirmative steps to apply for, a green card; or have an application pending to change your status to that of a lawful permanent resident of the United States.

Do you want to file Form 8843

If you're here on an type F, J, M, or Q visa, filing Form 8843 is crucial. It exempts you from the Substantial Presence Test, potentially altering your tax status.

As a student stayed most of the time at US, I filled 8843.

Enter the number of days in 2023 you claim you can exclude for purposes of the substantial presence test

As an F-1 student, you'll likely exclude all days present in the U.S. during the year from the Substantial Presence Test.

Reporting Income

W-2 Forms

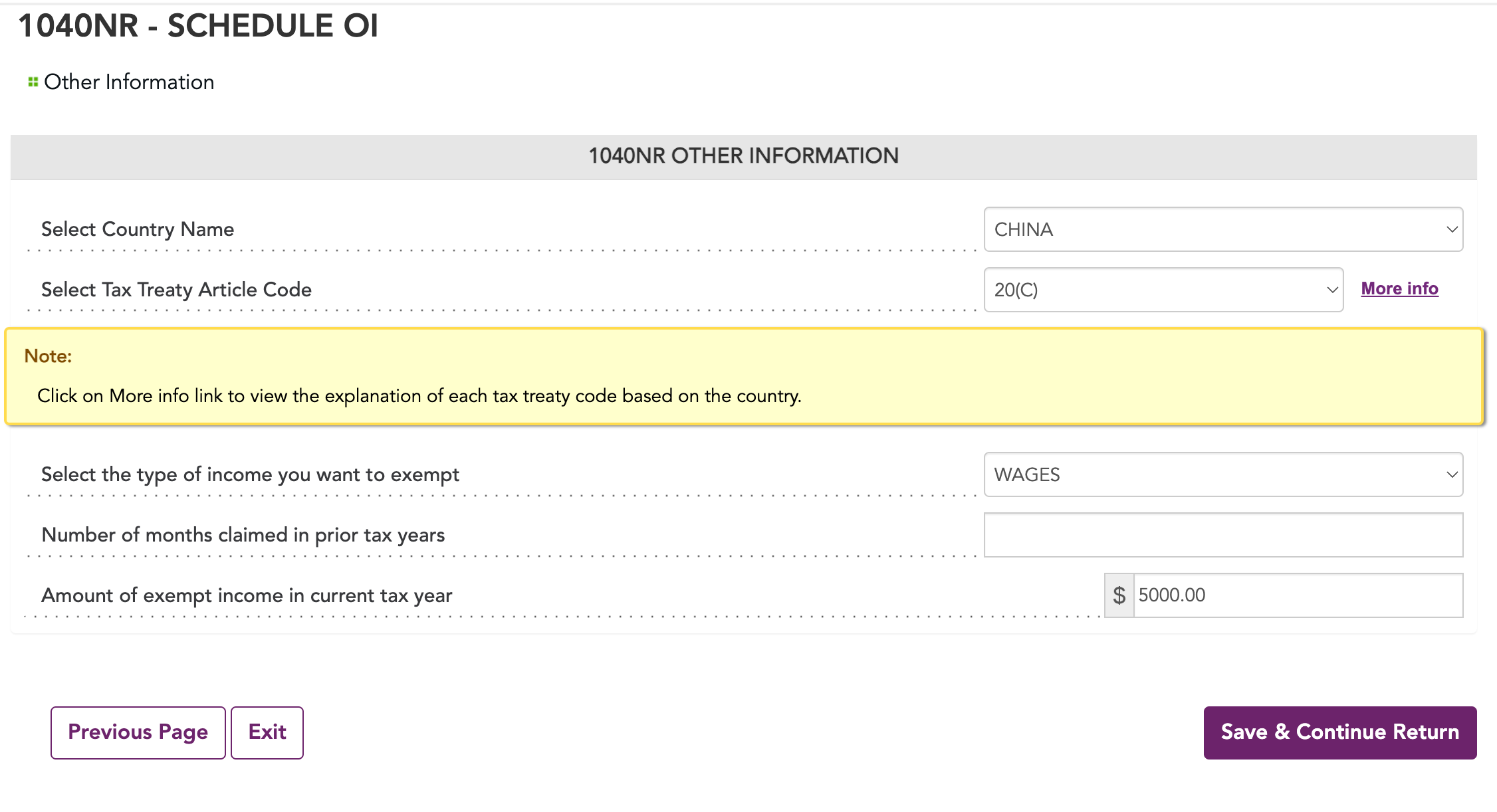

Your university will provide a W-2 form. Remember to apply treaty article 20(c) to your wages. The process changes slightly depending on whether you received only a W-2 or also a 1042-S.

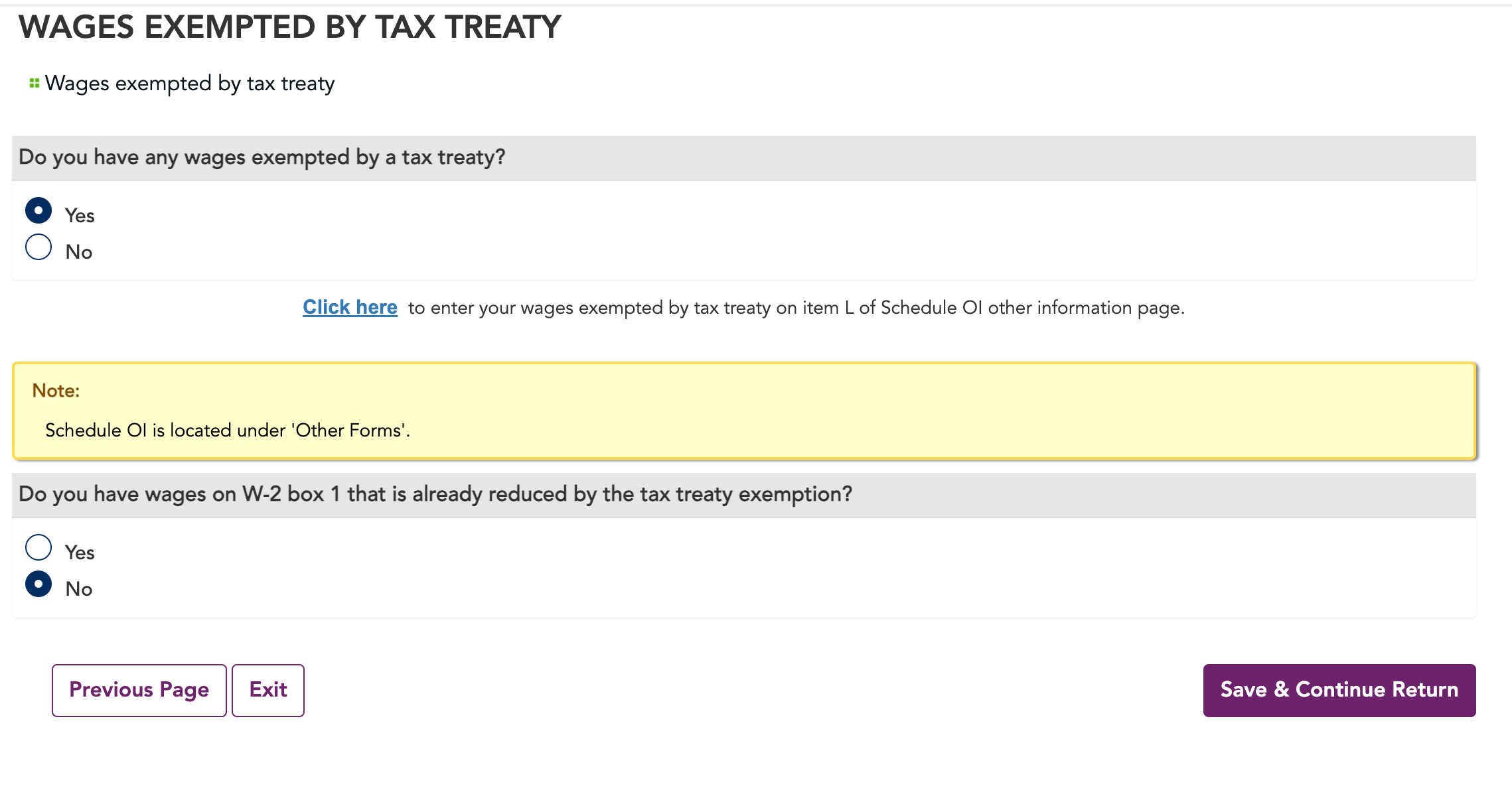

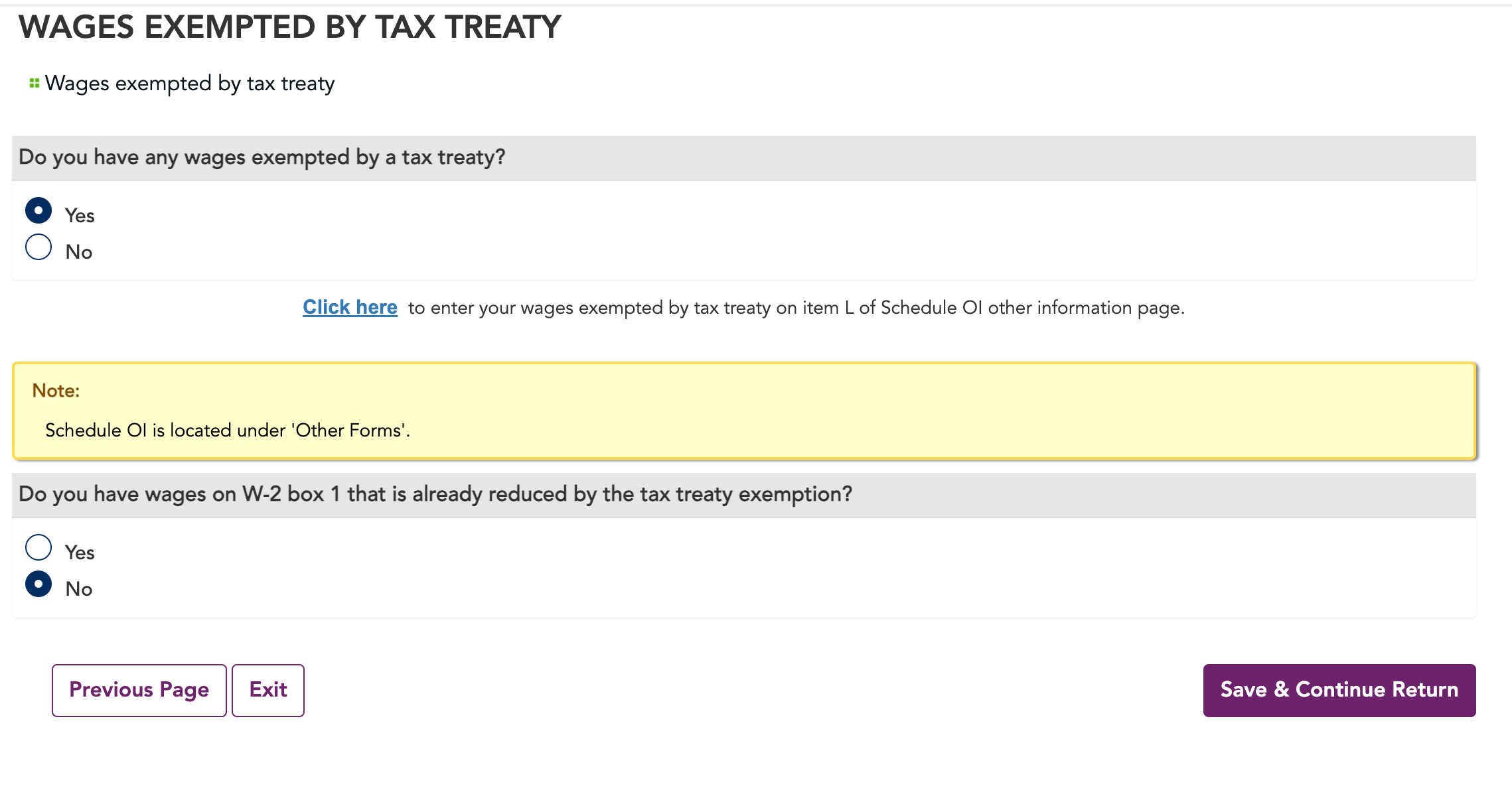

- You only received a W-2 (that's what NC State University did)

- After done with W-2, Choose exempt under treaty. First, fill Schedule OI. Then, choose No for "Do you have wages on W-2 box 1 that is already reduced by the tax treaty exemption"

Press "Click Here"

- You got W-2 (without a withhold of $5000) and a 1040-S

- Complete your W-2 as normal, but for the 1042-S should be completed with a statement of exempt under treaty, followed by a statement of $5,000 in 1040NR OI, with an article code of 20(c).

Dividends and Interest

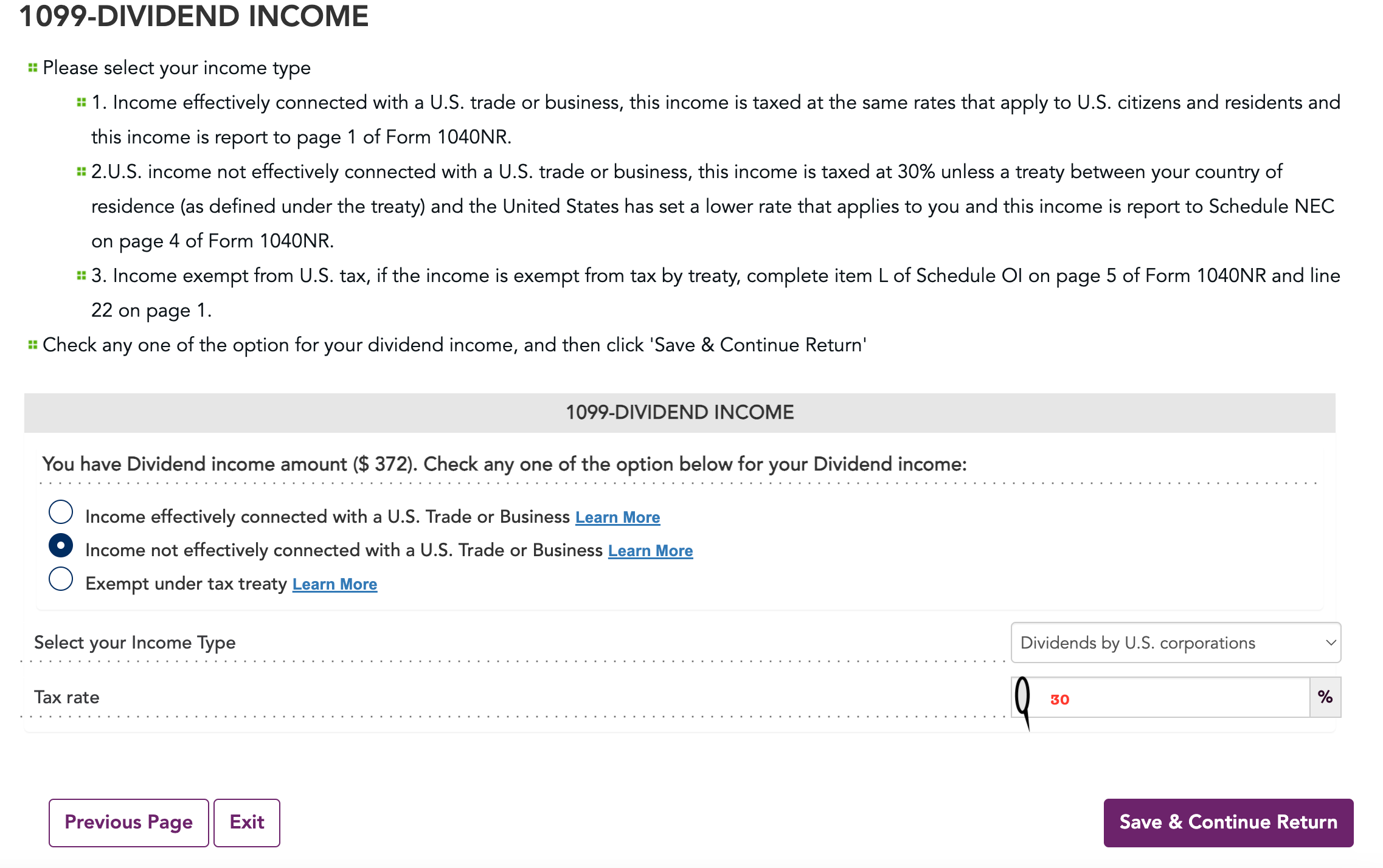

For dividends (reported on Form 1099-DIV) and interest, nonresident aliens face a default 30% tax rate, subject to reductions under tax treaties.

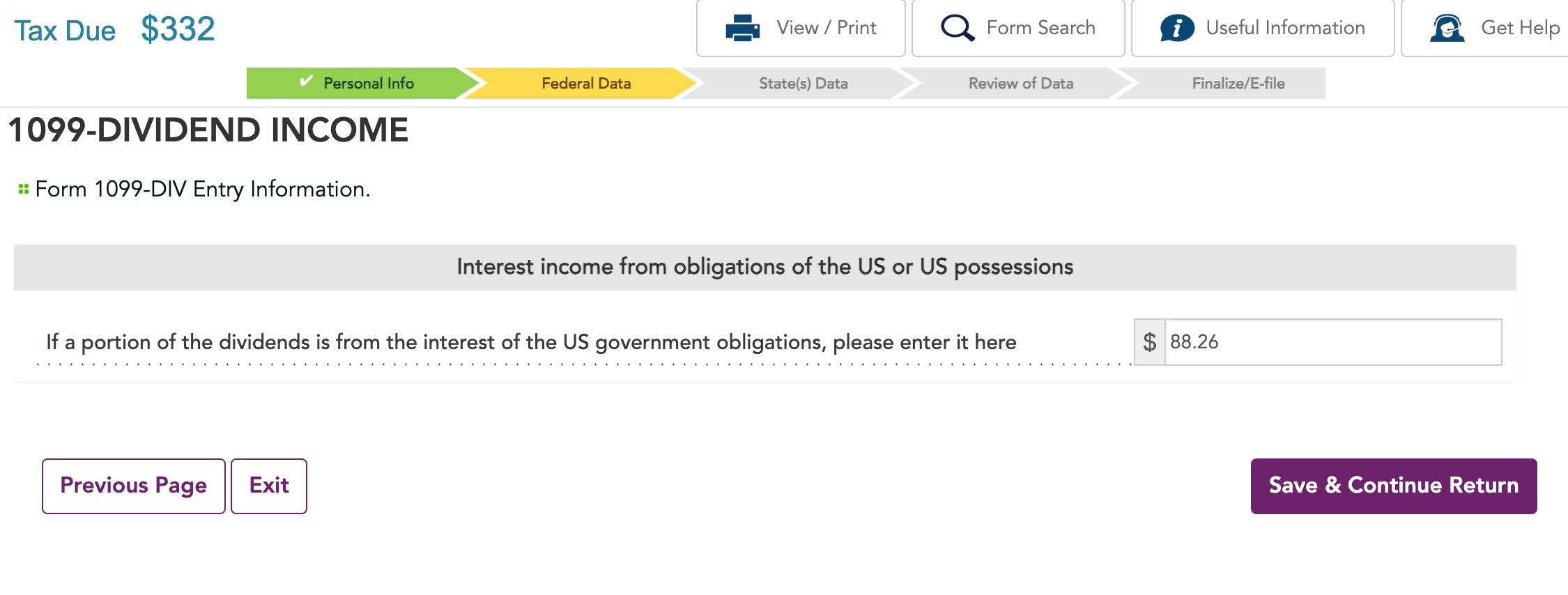

1099DIV

- SSN can be used for TIN (Tax Identification Number)

- A flat tax of 30 percent (or lower treaty) rate is imposed on U.S.

- Reminder this, Fidelity's SPAXX investment has about 30% is for the US government investment.

- Remember to put the same amount in the state tax section as well (except for CA and NY)

1099INT and 1042S

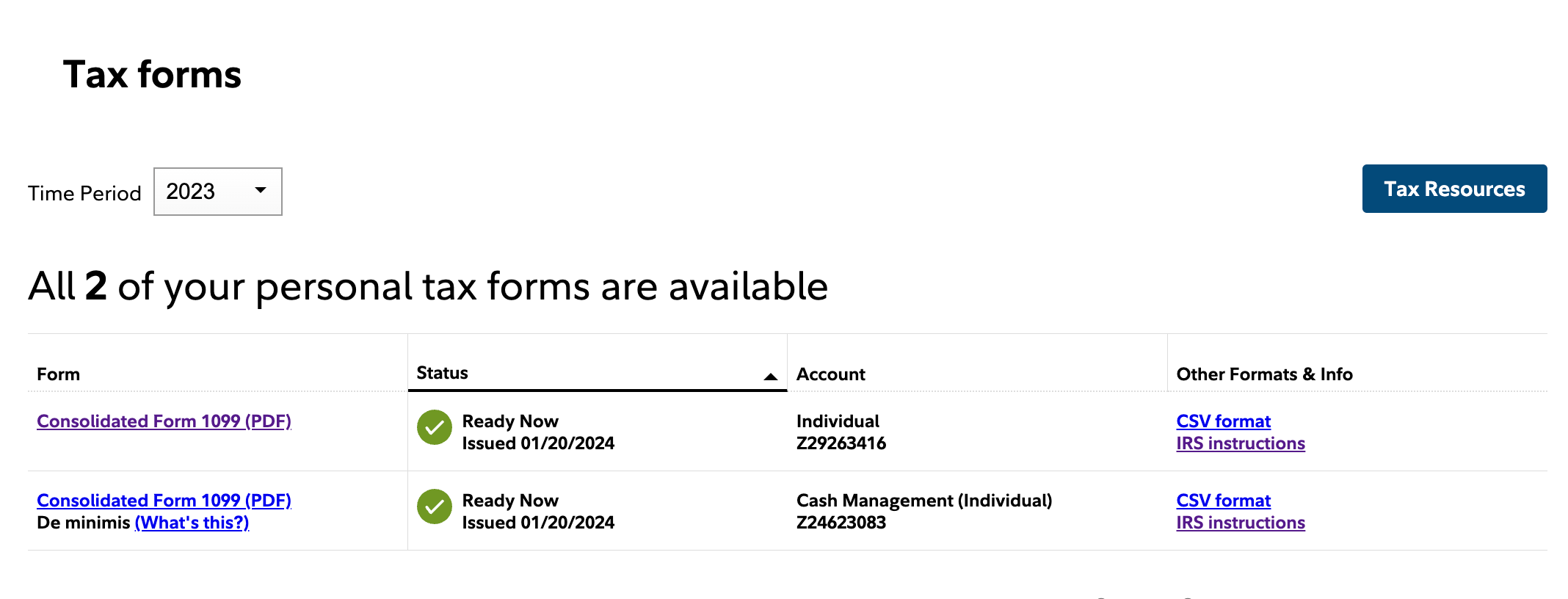

If you submit Form W-8BEN that indicate that you are a NRA, to your bank or investment institution, you should receive Form 1042-S. (I received it from Chase.) Or, you will get 1099-INT. (I got it from Fidelity).

1099INT

Attach it at the end.

1042S

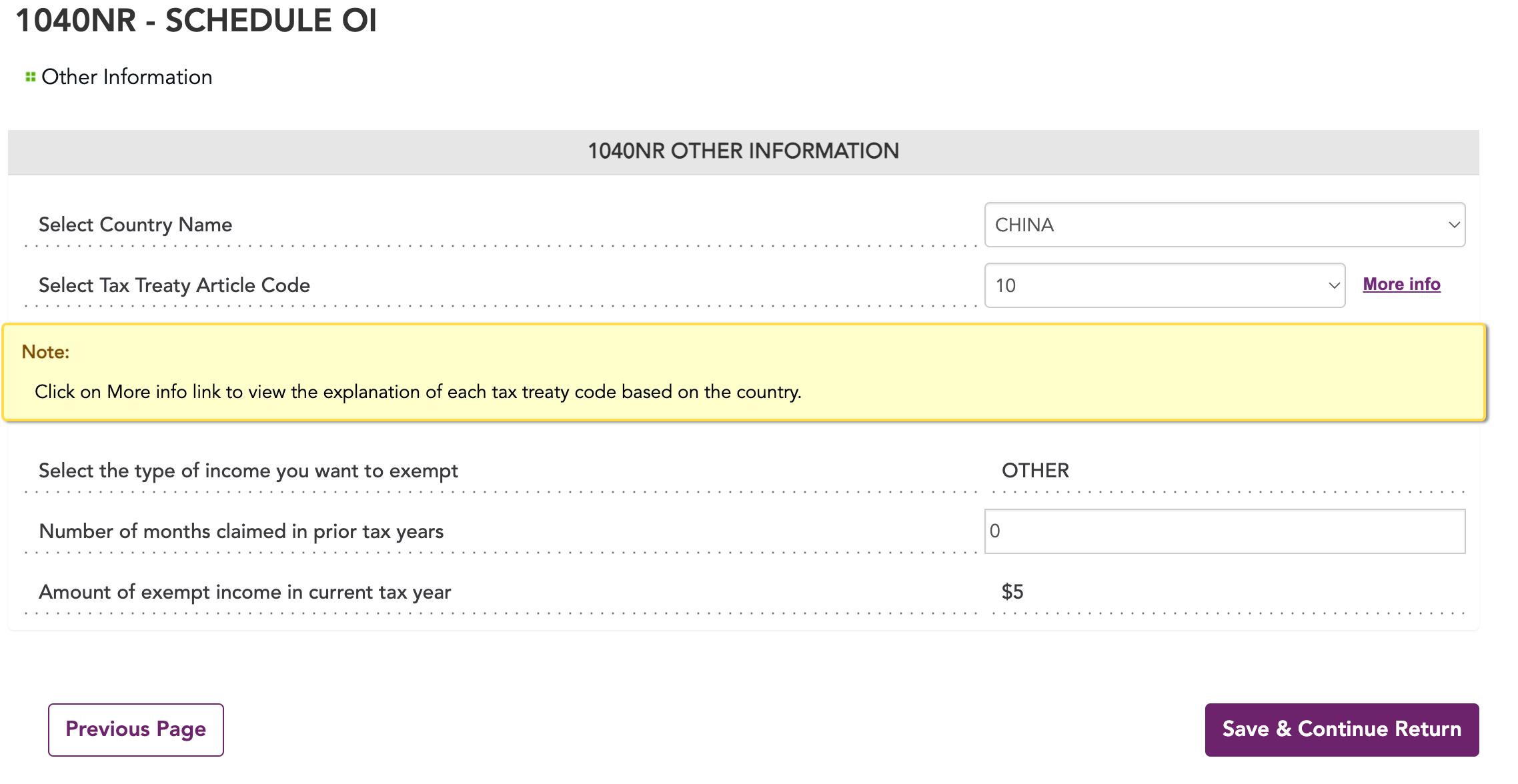

Choose Code 10 (Interest) for SCHEDULE OI.

1040NR SCHEDULE OI

Choose YES for "Were you subject to tax in foreign country on any of the income show above"

Tesla Clean Vehicle Credit

For those interested in clean vehicle credits.

- go to https://www.tesla.com/support/ira-clean-vehicle-report/2023 to generate IRS form 15400

- Search form 8936 and Start

- fill form 8936 Qualified Plug-in Electric Drive Motor Vehicle Credit|

Final Reminder

Don't play with it

Individuals may be fined up to $100,000 for filing a false return in addition to being sentenced to prison for up to three years

Reference and Useful Links

- https://www.luweicky.com/2021/03/oltefile-1040nr8843 (Recommend)

- https://www.uscardforum.com/t/topic/147110

- https://www.uscardforum.com/t/topic/25911

Contributor

Canarypwn

Canarypwn